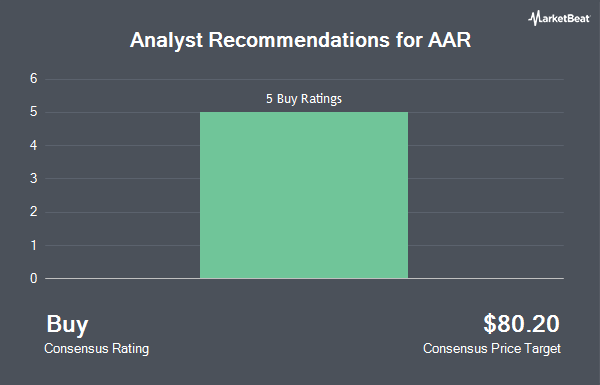

AAR Corp. (NYSE:AIR - Get Free Report) has received a consensus recommendation of "Buy" from the five analysts that are currently covering the firm, MarketBeat reports. Five investment analysts have rated the stock with a buy rating. The average 12 month target price among brokers that have updated their coverage on the stock in the last year is $80.20.

A number of research firms recently weighed in on AIR. Wall Street Zen raised shares of AAR from a "sell" rating to a "hold" rating in a research note on Saturday, April 19th. KeyCorp cut their price objective on shares of AAR from $83.00 to $80.00 and set an "overweight" rating on the stock in a report on Wednesday, April 2nd. Finally, Truist Financial dropped their target price on AAR from $81.00 to $78.00 and set a "buy" rating on the stock in a research report on Friday, March 28th.

Check Out Our Latest Stock Report on AIR

Institutional Investors Weigh In On AAR

A number of institutional investors have recently modified their holdings of AIR. Hughes Financial Services LLC acquired a new stake in AAR in the 1st quarter valued at $28,000. Putney Financial Group LLC purchased a new stake in AAR in the 4th quarter valued at $30,000. Virtus Fund Advisers LLC purchased a new position in shares of AAR during the 4th quarter worth $36,000. Virtus Advisers LLC acquired a new stake in AAR during the first quarter worth about $47,000. Finally, Sterling Capital Management LLC boosted its holdings in AAR by 761.2% in the 4th quarter. Sterling Capital Management LLC now owns 887 shares of the aerospace company's stock valued at $54,000 after purchasing an additional 784 shares during the last quarter. 90.74% of the stock is currently owned by institutional investors and hedge funds.

AAR Trading Down 0.6%

Shares of AIR traded down $0.37 during mid-day trading on Friday, reaching $59.99. 17,752 shares of the company's stock traded hands, compared to its average volume of 274,423. The company has a debt-to-equity ratio of 0.84, a current ratio of 2.68 and a quick ratio of 1.27. The stock's 50-day moving average is $57.89 and its two-hundred day moving average is $63.14. AAR has a 12 month low of $46.51 and a 12 month high of $76.34. The stock has a market cap of $2.17 billion, a P/E ratio of 214.26 and a beta of 1.40.

AAR (NYSE:AIR - Get Free Report) last announced its quarterly earnings data on Thursday, March 27th. The aerospace company reported $0.99 earnings per share for the quarter, beating analysts' consensus estimates of $0.96 by $0.03. AAR had a net margin of 0.41% and a return on equity of 10.46%. The company had revenue of $678.20 million during the quarter, compared to analyst estimates of $699.13 million. During the same quarter last year, the business posted $0.85 EPS. The firm's revenue for the quarter was up 19.5% on a year-over-year basis. Research analysts forecast that AAR will post 3.77 earnings per share for the current fiscal year.

About AAR

(

Get Free ReportAAR Corp. provides products and services to commercial aviation, government, and defense markets worldwide. The Parts Supply segment leases and sells aircraft components and replacement parts. The Repair & Engineering segment provides airframe maintenance services, such as airframe inspection, painting, line maintenance, airframe modification, structural repair, avionics service and installation, exterior and interior refurbishment, and engineering and support services; component repair services comprising maintenance, repair, and overhaul (MRO) services, engine and airframe accessories, and interior refurbishment; and landing gear overhaul services, including repair services on wheels and brakes.

See Also

Before you consider AAR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AAR wasn't on the list.

While AAR currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.