Centiva Capital LP acquired a new stake in shares of Oscar Health, Inc. (NYSE:OSCR - Free Report) during the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm acquired 22,741 shares of the company's stock, valued at approximately $306,000.

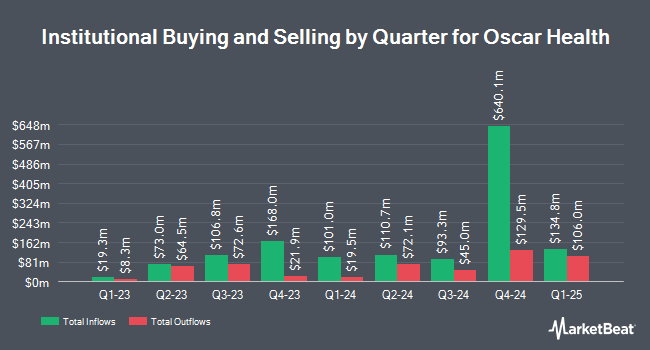

Other hedge funds have also made changes to their positions in the company. Barclays PLC grew its position in Oscar Health by 217.5% in the third quarter. Barclays PLC now owns 325,818 shares of the company's stock worth $6,911,000 after buying an additional 223,189 shares during the last quarter. Nordea Investment Management AB acquired a new position in Oscar Health in the fourth quarter worth approximately $1,056,000. Harbor Capital Advisors Inc. grew its position in Oscar Health by 39.9% in the fourth quarter. Harbor Capital Advisors Inc. now owns 128,167 shares of the company's stock worth $1,723,000 after buying an additional 36,577 shares during the last quarter. Hennessy Advisors Inc. grew its position in Oscar Health by 550.3% in the fourth quarter. Hennessy Advisors Inc. now owns 4,188,400 shares of the company's stock worth $56,292,000 after buying an additional 3,544,300 shares during the last quarter. Finally, Rolek Wealth Management LLC acquired a new position in Oscar Health in the fourth quarter worth approximately $208,000. Institutional investors and hedge funds own 75.70% of the company's stock.

Wall Street Analyst Weigh In

Separately, Wells Fargo & Company lowered shares of Oscar Health from an "overweight" rating to an "equal weight" rating and decreased their price target for the stock from $20.00 to $16.00 in a research report on Thursday, March 13th. Two investment analysts have rated the stock with a sell rating, two have assigned a hold rating, two have given a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus target price of $20.08.

Get Our Latest Stock Analysis on OSCR

Oscar Health Stock Up 5.8%

Shares of NYSE OSCR traded up $0.96 during mid-day trading on Friday, reaching $17.52. 10,504,285 shares of the company traded hands, compared to its average volume of 4,189,797. The stock has a market cap of $4.39 billion, a PE ratio of -875.31 and a beta of 1.75. The company has a debt-to-equity ratio of 0.26, a quick ratio of 0.73 and a current ratio of 0.73. Oscar Health, Inc. has a fifty-two week low of $11.20 and a fifty-two week high of $23.79. The company's fifty day moving average is $13.46 and its two-hundred day moving average is $14.66.

Oscar Health (NYSE:OSCR - Get Free Report) last released its earnings results on Wednesday, May 7th. The company reported $0.92 earnings per share for the quarter, topping analysts' consensus estimates of $0.83 by $0.09. The firm had revenue of $3 billion during the quarter, compared to analyst estimates of $2.87 billion. Oscar Health had a net margin of 0.28% and a return on equity of 2.28%. The business's revenue was up 42.2% on a year-over-year basis. During the same quarter in the previous year, the business earned $0.62 EPS. On average, analysts expect that Oscar Health, Inc. will post 0.69 earnings per share for the current year.

Insiders Place Their Bets

In other news, Director Elbert O. Jr. Robinson sold 25,000 shares of the company's stock in a transaction dated Monday, May 12th. The shares were sold at an average price of $16.43, for a total transaction of $410,750.00. Following the completion of the transaction, the director now owns 64,512 shares of the company's stock, valued at approximately $1,059,932.16. This represents a 27.93% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Company insiders own 24.39% of the company's stock.

Oscar Health Company Profile

(

Free Report)

Oscar Health, Inc operates as a health insurance in the United States. The company offers health plans in individual and small group markets, as well as +Oscar, a technology driven platform that help providers and payors directly enable their shift to value-based care. It also provides reinsurance products.

Featured Stories

Before you consider Oscar Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oscar Health wasn't on the list.

While Oscar Health currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.