Ensign Peak Advisors Inc decreased its holdings in shares of Commercial Metals (NYSE:CMC - Free Report) by 14.3% in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 49,511 shares of the basic materials company's stock after selling 8,237 shares during the quarter. Ensign Peak Advisors Inc's holdings in Commercial Metals were worth $2,456,000 at the end of the most recent quarter.

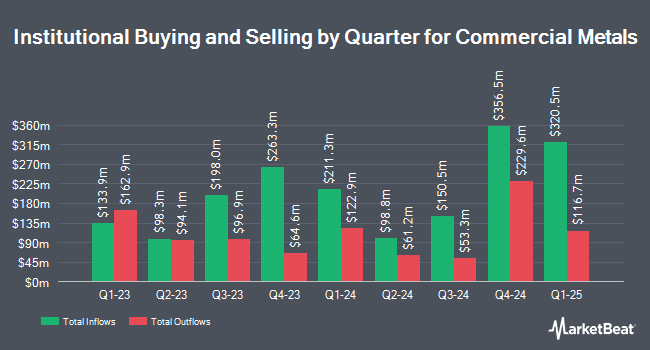

A number of other institutional investors have also recently made changes to their positions in the stock. Boston Partners increased its holdings in shares of Commercial Metals by 6.4% in the fourth quarter. Boston Partners now owns 4,055,150 shares of the basic materials company's stock worth $201,178,000 after buying an additional 243,921 shares during the period. Victory Capital Management Inc. lifted its position in Commercial Metals by 11.3% during the fourth quarter. Victory Capital Management Inc. now owns 2,422,427 shares of the basic materials company's stock valued at $120,152,000 after buying an additional 245,468 shares during the period. Franklin Resources Inc. lifted its position in Commercial Metals by 87.0% during the 4th quarter. Franklin Resources Inc. now owns 1,919,445 shares of the basic materials company's stock valued at $95,204,000 after acquiring an additional 893,094 shares during the period. First Trust Advisors LP lifted its holdings in shares of Commercial Metals by 34.1% during the fourth quarter. First Trust Advisors LP now owns 1,754,840 shares of the basic materials company's stock valued at $87,040,000 after purchasing an additional 446,317 shares during the last quarter. Finally, Northern Trust Corp boosted its holdings in Commercial Metals by 10.2% in the fourth quarter. Northern Trust Corp now owns 1,749,877 shares of the basic materials company's stock worth $86,794,000 after acquiring an additional 162,201 shares in the last quarter. Institutional investors own 86.90% of the company's stock.

Commercial Metals Price Performance

Shares of NYSE CMC traded up $0.06 during midday trading on Wednesday, reaching $47.54. 124,259 shares of the stock traded hands, compared to its average volume of 953,929. The company's 50 day moving average is $44.98 and its 200 day moving average is $50.25. The company has a debt-to-equity ratio of 0.29, a current ratio of 2.76 and a quick ratio of 1.94. Commercial Metals has a one year low of $37.92 and a one year high of $64.53. The stock has a market capitalization of $5.37 billion, a PE ratio of 42.85, a P/E/G ratio of 2.62 and a beta of 1.29.

Commercial Metals (NYSE:CMC - Get Free Report) last issued its quarterly earnings data on Thursday, March 20th. The basic materials company reported $0.26 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.31 by ($0.05). The business had revenue of $1.75 billion for the quarter, compared to analysts' expectations of $1.73 billion. Commercial Metals had a net margin of 1.70% and a return on equity of 9.88%. The business's quarterly revenue was down 5.1% compared to the same quarter last year. During the same period in the previous year, the business earned $0.88 earnings per share. On average, equities research analysts anticipate that Commercial Metals will post 3.09 earnings per share for the current year.

Commercial Metals Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Wednesday, April 9th. Investors of record on Monday, March 31st were paid a dividend of $0.18 per share. The ex-dividend date of this dividend was Monday, March 31st. This represents a $0.72 annualized dividend and a dividend yield of 1.51%. Commercial Metals's dividend payout ratio (DPR) is presently 120.00%.

Insider Activity

In related news, Director John R. Mcpherson bought 2,475 shares of the stock in a transaction that occurred on Friday, April 4th. The stock was bought at an average cost of $40.42 per share, for a total transaction of $100,039.50. Following the purchase, the director now directly owns 15,141 shares of the company's stock, valued at approximately $611,999.22. This trade represents a 19.54% increase in their ownership of the stock. The purchase was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Company insiders own 0.46% of the company's stock.

Wall Street Analyst Weigh In

Several research analysts have recently issued reports on the stock. Morgan Stanley dropped their target price on shares of Commercial Metals from $56.00 to $53.00 and set an "equal weight" rating on the stock in a research note on Friday, March 7th. UBS Group decreased their price target on shares of Commercial Metals from $54.00 to $49.00 and set a "neutral" rating on the stock in a research report on Monday, March 24th. Finally, BMO Capital Markets cut their target price on Commercial Metals from $58.00 to $54.00 and set a "market perform" rating for the company in a research report on Friday, March 21st. Six analysts have rated the stock with a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Hold" and an average target price of $60.33.

Get Our Latest Research Report on CMC

About Commercial Metals

(

Free Report)

Commercial Metals Company manufactures, recycles, and fabricates steel and metal products, and related materials and services in the United States, Poland, China, and internationally. It operates through two segments, North America and Europe. The company processes and sells ferrous and nonferrous scrap metals to steel mills and foundries, aluminum sheet and ingot manufacturers, brass and bronze ingot makers, copper refineries and mills, secondary lead smelters, specialty steel mills, high temperature alloy manufacturers, and other consumers.

Featured Stories

Before you consider Commercial Metals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Commercial Metals wasn't on the list.

While Commercial Metals currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.