Avity Investment Management Inc. cut its stake in shares of Amphenol Co. (NYSE:APH - Free Report) by 0.5% during the first quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 681,352 shares of the electronics maker's stock after selling 3,149 shares during the period. Amphenol makes up about 3.6% of Avity Investment Management Inc.'s holdings, making the stock its 7th biggest position. Avity Investment Management Inc. owned 0.06% of Amphenol worth $44,690,000 as of its most recent SEC filing.

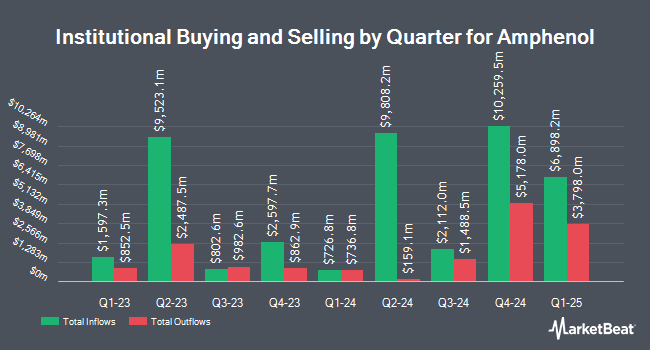

A number of other institutional investors and hedge funds also recently modified their holdings of APH. Tacita Capital Inc raised its position in shares of Amphenol by 328.9% during the fourth quarter. Tacita Capital Inc now owns 386 shares of the electronics maker's stock worth $27,000 after purchasing an additional 296 shares during the period. Sierra Ocean LLC acquired a new stake in shares of Amphenol during the fourth quarter worth $28,000. Rialto Wealth Management LLC acquired a new stake in shares of Amphenol during the fourth quarter worth $28,000. Rakuten Securities Inc. raised its position in shares of Amphenol by 703.8% during the fourth quarter. Rakuten Securities Inc. now owns 418 shares of the electronics maker's stock worth $29,000 after purchasing an additional 366 shares during the period. Finally, OFI Invest Asset Management acquired a new stake in shares of Amphenol during the fourth quarter worth $44,000. 97.01% of the stock is owned by institutional investors and hedge funds.

Amphenol Stock Down 0.4%

Shares of APH traded down $0.41 during trading hours on Monday, hitting $92.95. 7,701,672 shares of the company were exchanged, compared to its average volume of 7,484,168. The company has a market cap of $112.43 billion, a PE ratio of 48.54, a PEG ratio of 1.92 and a beta of 1.12. The firm's 50 day moving average is $77.23 and its 200-day moving average is $72.25. Amphenol Co. has a 52 week low of $54.77 and a 52 week high of $94.14. The company has a debt-to-equity ratio of 0.66, a quick ratio of 1.75 and a current ratio of 2.37.

Amphenol (NYSE:APH - Get Free Report) last released its quarterly earnings results on Wednesday, April 23rd. The electronics maker reported $0.63 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.52 by $0.11. The company had revenue of $4.81 billion during the quarter, compared to the consensus estimate of $4.20 billion. Amphenol had a return on equity of 25.67% and a net margin of 15.92%. The firm's revenue was up 47.7% on a year-over-year basis. During the same quarter in the prior year, the company posted $0.40 EPS. On average, equities research analysts forecast that Amphenol Co. will post 2.36 EPS for the current fiscal year.

Amphenol Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, July 9th. Shareholders of record on Tuesday, June 17th will be issued a $0.165 dividend. This represents a $0.66 dividend on an annualized basis and a yield of 0.71%. The ex-dividend date is Tuesday, June 17th. Amphenol's dividend payout ratio (DPR) is currently 32.04%.

Insider Buying and Selling at Amphenol

In other Amphenol news, insider William J. Doherty sold 160,000 shares of the firm's stock in a transaction that occurred on Friday, May 30th. The stock was sold at an average price of $89.54, for a total value of $14,326,400.00. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, insider Luc Walter sold 286,000 shares of the firm's stock in a transaction that occurred on Tuesday, June 3rd. The stock was sold at an average price of $91.43, for a total value of $26,148,980.00. Following the completion of the sale, the insider now owns 451,790 shares of the company's stock, valued at $41,307,159.70. This represents a 38.76% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 3,764,500 shares of company stock valued at $294,839,785 in the last 90 days. 1.67% of the stock is currently owned by insiders.

Wall Street Analysts Forecast Growth

A number of brokerages have recently issued reports on APH. TD Securities boosted their target price on Amphenol from $63.00 to $70.00 and gave the stock a "hold" rating in a research report on Thursday, May 1st. The Goldman Sachs Group upped their price target on Amphenol from $72.00 to $80.00 and gave the company a "buy" rating in a research report on Thursday, April 24th. Evercore ISI upped their price target on Amphenol from $88.00 to $105.00 and gave the company an "outperform" rating in a research report on Thursday. Citigroup upped their price target on Amphenol from $85.00 to $100.00 and gave the company a "buy" rating in a research report on Tuesday, May 27th. Finally, US Capital Advisors set a $85.00 price target on Amphenol in a research report on Thursday, April 24th. Five investment analysts have rated the stock with a hold rating and eight have issued a buy rating to the company. According to data from MarketBeat, Amphenol has a consensus rating of "Moderate Buy" and a consensus target price of $86.31.

Read Our Latest Analysis on APH

Amphenol Profile

(

Free Report)

Amphenol Corporation, together with its subsidiaries, primarily designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally. It operates through three segments: Harsh Environment Solutions, Communications Solutions, and Interconnect and Sensor Systems.

Featured Stories

Before you consider Amphenol, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amphenol wasn't on the list.

While Amphenol currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.