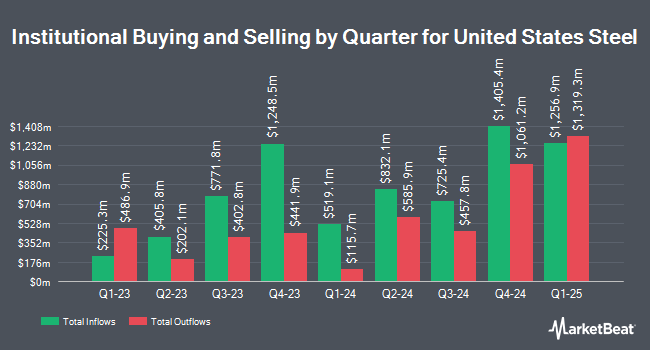

California State Teachers Retirement System cut its position in shares of United States Steel Co. (NYSE:X - Free Report) by 3.1% during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 210,353 shares of the basic materials company's stock after selling 6,729 shares during the quarter. California State Teachers Retirement System owned 0.09% of United States Steel worth $7,150,000 at the end of the most recent quarter.

A number of other large investors have also modified their holdings of the company. SG Americas Securities LLC raised its holdings in shares of United States Steel by 25.8% in the fourth quarter. SG Americas Securities LLC now owns 4,575 shares of the basic materials company's stock valued at $156,000 after purchasing an additional 937 shares during the last quarter. Janney Montgomery Scott LLC boosted its stake in shares of United States Steel by 153.7% in the fourth quarter. Janney Montgomery Scott LLC now owns 15,201 shares of the basic materials company's stock valued at $517,000 after buying an additional 9,210 shares during the period. Blue Trust Inc. lifted its position in United States Steel by 36.6% during the fourth quarter. Blue Trust Inc. now owns 3,781 shares of the basic materials company's stock worth $134,000 after purchasing an additional 1,014 shares during the period. KBC Group NV lifted its holdings in shares of United States Steel by 57.6% in the fourth quarter. KBC Group NV now owns 8,796 shares of the basic materials company's stock worth $299,000 after acquiring an additional 3,216 shares during the last quarter. Finally, Heck Capital Advisors LLC bought a new position in United States Steel in the fourth quarter valued at about $554,000. 81.92% of the stock is currently owned by institutional investors and hedge funds.

United States Steel Stock Performance

United States Steel stock traded down $0.01 during trading hours on Wednesday, hitting $53.75. The company had a trading volume of 4,231,855 shares, compared to its average volume of 6,195,815. The firm has a 50-day moving average of $44.07 and a 200 day moving average of $39.45. The firm has a market cap of $12.17 billion, a PE ratio of 36.07, a PEG ratio of 1.53 and a beta of 1.82. The company has a debt-to-equity ratio of 0.36, a current ratio of 1.55 and a quick ratio of 0.91. United States Steel Co. has a one year low of $26.92 and a one year high of $54.03.

United States Steel (NYSE:X - Get Free Report) last announced its quarterly earnings results on Thursday, May 1st. The basic materials company reported ($0.39) EPS for the quarter, missing analysts' consensus estimates of ($0.35) by ($0.04). United States Steel had a return on equity of 4.27% and a net margin of 2.46%. The company had revenue of $3.73 billion during the quarter, compared to analysts' expectations of $3.54 billion. During the same period last year, the firm earned $0.82 earnings per share. United States Steel's revenue for the quarter was down 10.4% on a year-over-year basis. On average, sell-side analysts expect that United States Steel Co. will post 1.43 earnings per share for the current year.

United States Steel Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, June 11th. Stockholders of record on Monday, May 12th will be given a dividend of $0.05 per share. This represents a $0.20 annualized dividend and a dividend yield of 0.37%. The ex-dividend date of this dividend is Monday, May 12th. United States Steel's payout ratio is currently 68.97%.

Analysts Set New Price Targets

Several research firms have weighed in on X. Morgan Stanley boosted their price objective on United States Steel from $35.00 to $38.00 and gave the stock an "equal weight" rating in a research report on Monday, May 5th. Jefferies Financial Group reiterated a "hold" rating and set a $55.00 price target (up previously from $50.00) on shares of United States Steel in a research report on Tuesday, May 27th. JPMorgan Chase & Co. boosted their price target on shares of United States Steel from $39.00 to $55.00 and gave the stock a "neutral" rating in a research note on Monday. Glj Research lowered United States Steel from a "strong-buy" rating to a "strong sell" rating in a research report on Friday, May 30th. Finally, Wolfe Research reaffirmed a "peer perform" rating on shares of United States Steel in a research note on Tuesday, May 27th. One investment analyst has rated the stock with a sell rating, seven have assigned a hold rating and one has assigned a buy rating to the stock. According to MarketBeat.com, the stock presently has an average rating of "Hold" and an average price target of $43.80.

Get Our Latest Analysis on United States Steel

About United States Steel

(

Free Report)

United States Steel Corporation produces and sells flat-rolled and tubular steel products primarily in North America and Europe. The company operates through North American Flat-Rolled (Flat-Rolled), Mini Mill, U. S. Steel Europe (USSE), and Tubular Products (Tubular) segments. The Flat-Rolled segment offers slabs, strip mill plates, sheets, and tin mill products, as well as iron ore and coke.

See Also

Before you consider United States Steel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United States Steel wasn't on the list.

While United States Steel currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.