Farmers & Merchants Investments Inc. cut its stake in shares of CVS Health Co. (NYSE:CVS - Free Report) by 1.5% during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 262,344 shares of the pharmacy operator's stock after selling 4,027 shares during the period. Farmers & Merchants Investments Inc.'s holdings in CVS Health were worth $17,774,000 at the end of the most recent reporting period.

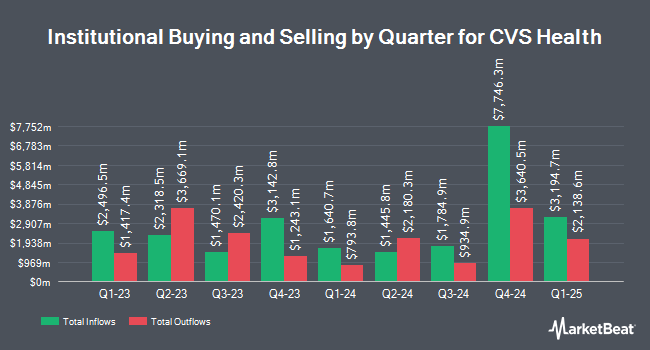

Several other hedge funds and other institutional investors have also recently modified their holdings of CVS. Stonebridge Financial Group LLC bought a new stake in shares of CVS Health during the fourth quarter valued at about $28,000. Hopwood Financial Services Inc. purchased a new position in shares of CVS Health during the fourth quarter worth about $29,000. McIlrath & Eck LLC grew its holdings in shares of CVS Health by 32.6% during the fourth quarter. McIlrath & Eck LLC now owns 707 shares of the pharmacy operator's stock worth $32,000 after purchasing an additional 174 shares in the last quarter. Financial Perspectives Inc grew its holdings in shares of CVS Health by 137.5% during the fourth quarter. Financial Perspectives Inc now owns 805 shares of the pharmacy operator's stock worth $36,000 after purchasing an additional 466 shares in the last quarter. Finally, MidAtlantic Capital Management Inc. grew its holdings in shares of CVS Health by 112.1% during the fourth quarter. MidAtlantic Capital Management Inc. now owns 827 shares of the pharmacy operator's stock worth $37,000 after purchasing an additional 437 shares in the last quarter. 80.66% of the stock is currently owned by institutional investors.

CVS Health Stock Performance

NYSE:CVS traded up $1.07 on Friday, hitting $67.42. The stock had a trading volume of 7,560,954 shares, compared to its average volume of 10,981,603. The stock has a market cap of $85.29 billion, a price-to-earnings ratio of 18.42, a price-to-earnings-growth ratio of 0.98 and a beta of 0.56. The company has a quick ratio of 0.60, a current ratio of 0.81 and a debt-to-equity ratio of 0.80. The business's 50-day simple moving average is $65.15 and its two-hundred day simple moving average is $60.15. CVS Health Co. has a 52-week low of $43.56 and a 52-week high of $72.51.

CVS Health (NYSE:CVS - Get Free Report) last posted its quarterly earnings data on Thursday, May 1st. The pharmacy operator reported $2.25 EPS for the quarter, topping the consensus estimate of $1.62 by $0.63. The firm had revenue of $94.59 billion for the quarter, compared to the consensus estimate of $93.07 billion. CVS Health had a return on equity of 9.11% and a net margin of 1.24%. The business's revenue for the quarter was up 7.0% compared to the same quarter last year. During the same quarter last year, the company earned $1.31 earnings per share. As a group, research analysts predict that CVS Health Co. will post 5.89 earnings per share for the current year.

CVS Health Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Thursday, May 1st. Shareholders of record on Tuesday, April 22nd were paid a $0.665 dividend. This represents a $2.66 dividend on an annualized basis and a yield of 3.95%. The ex-dividend date was Tuesday, April 22nd. CVS Health's payout ratio is 63.48%.

Insiders Place Their Bets

In other news, Director Guy P. Sansone acquired 1,570 shares of CVS Health stock in a transaction on Thursday, June 5th. The shares were acquired at an average price of $63.70 per share, with a total value of $100,009.00. Following the purchase, the director now directly owns 12,007 shares in the company, valued at $764,845.90. The trade was a 15.04% increase in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Corporate insiders own 1.22% of the company's stock.

Analyst Ratings Changes

Several research analysts have recently commented on the company. Piper Sandler boosted their price objective on CVS Health from $72.00 to $74.00 and gave the stock an "overweight" rating in a report on Friday, March 21st. Robert W. Baird increased their price objective on CVS Health from $51.00 to $71.00 and gave the company a "neutral" rating in a research note on Tuesday, April 15th. Barclays set a $79.00 target price on CVS Health and gave the company an "overweight" rating in a report on Monday, June 2nd. Morgan Stanley reiterated an "overweight" rating on shares of CVS Health in a report on Tuesday, April 15th. Finally, Argus set a $77.00 target price on CVS Health in a research note on Tuesday, February 18th. Two research analysts have rated the stock with a hold rating, seventeen have given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $74.75.

Get Our Latest Report on CVS Health

CVS Health Profile

(

Free Report)

CVS Health Corporation provides health solutions in the United States. It operates through Health Care Benefits, Health Services, and Pharmacy & Consumer Wellness segments. The Health Care Benefits segment offers traditional, voluntary, and consumer-directed health insurance products and related services.

Read More

Before you consider CVS Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CVS Health wasn't on the list.

While CVS Health currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.