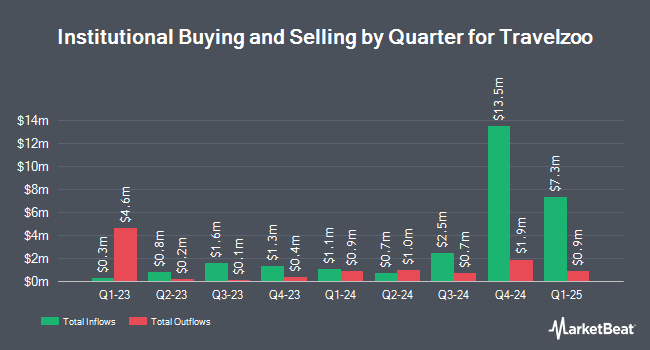

OMERS ADMINISTRATION Corp purchased a new position in Travelzoo (NASDAQ:TZOO - Free Report) in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 25,130 shares of the information services provider's stock, valued at approximately $501,000. OMERS ADMINISTRATION Corp owned about 0.21% of Travelzoo as of its most recent SEC filing.

A number of other institutional investors also recently added to or reduced their stakes in the company. Millennium Management LLC lifted its stake in Travelzoo by 528.4% in the fourth quarter. Millennium Management LLC now owns 77,307 shares of the information services provider's stock worth $1,542,000 after acquiring an additional 65,004 shares during the last quarter. Lazard Asset Management LLC purchased a new stake in shares of Travelzoo during the 4th quarter worth approximately $87,000. BNP Paribas Financial Markets purchased a new stake in shares of Travelzoo during the 4th quarter worth approximately $205,000. Ancora Advisors LLC purchased a new stake in shares of Travelzoo during the 4th quarter worth approximately $30,000. Finally, 683 Capital Management LLC purchased a new stake in shares of Travelzoo during the 4th quarter worth approximately $751,000. Hedge funds and other institutional investors own 27.39% of the company's stock.

Travelzoo Trading Down 2.8%

TZOO stock traded down $0.37 on Friday, hitting $12.87. The company's stock had a trading volume of 60,461 shares, compared to its average volume of 126,137. The firm has a 50 day moving average of $13.26 and a two-hundred day moving average of $17.07. Travelzoo has a 1 year low of $7.12 and a 1 year high of $24.85. The stock has a market cap of $142.79 million, a price-to-earnings ratio of 12.03 and a beta of 1.21.

Travelzoo (NASDAQ:TZOO - Get Free Report) last released its quarterly earnings results on Wednesday, April 30th. The information services provider reported $0.25 EPS for the quarter, missing the consensus estimate of $0.27 by ($0.02). Travelzoo had a net margin of 16.67% and a return on equity of 210.54%. The business had revenue of $23.14 million during the quarter, compared to analysts' expectations of $22.99 million. As a group, equities analysts forecast that Travelzoo will post 1.09 EPS for the current fiscal year.

Analysts Set New Price Targets

Several brokerages have recently weighed in on TZOO. Barrington Research restated an "outperform" rating and set a $17.00 price objective on shares of Travelzoo in a research report on Tuesday, April 29th. Noble Financial restated an "outperform" rating on shares of Travelzoo in a research report on Wednesday, April 30th. Five equities research analysts have rated the stock with a buy rating, According to data from MarketBeat, Travelzoo currently has a consensus rating of "Buy" and a consensus target price of $25.00.

Read Our Latest Report on Travelzoo

Insider Activity at Travelzoo

In other Travelzoo news, major shareholder Azzurro Capital Inc sold 25,000 shares of the business's stock in a transaction on Monday, March 31st. The shares were sold at an average price of $13.35, for a total value of $333,750.00. Following the transaction, the insider now directly owns 4,297,696 shares of the company's stock, valued at approximately $57,374,241.60. The trade was a 0.58% decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, CEO Holger Bartel sold 4,000 shares of the business's stock in a transaction on Wednesday, March 5th. The shares were sold at an average price of $15.42, for a total transaction of $61,680.00. The disclosure for this sale can be found here. Insiders sold a total of 106,000 shares of company stock worth $1,535,450 in the last 90 days. 57.45% of the stock is owned by insiders.

Travelzoo Company Profile

(

Free Report)

Travelzoo, together with its subsidiaries, operates as an Internet media company that provides travel, entertainment, and local experiences worldwide. It operates in four segments: Travelzoo North America, Travelzoo Europe, Jack's Flight Club, and New Initiatives. The company offers Travelzoo website, Travelzoo Top 20 email newsletters, Standalone email newsletters, Travelzoo Network, Travelzoo mobile applications, Jack's Flight Club website, Jack's Flight Club mobile applications, and Jack's Flight Club newsletters.

See Also

Before you consider Travelzoo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Travelzoo wasn't on the list.

While Travelzoo currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.