Sivia Capital Partners LLC grew its position in shares of Amphenol Co. (NYSE:APH - Free Report) by 61.9% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 8,127 shares of the electronics maker's stock after purchasing an additional 3,108 shares during the period. Sivia Capital Partners LLC's holdings in Amphenol were worth $533,000 at the end of the most recent reporting period.

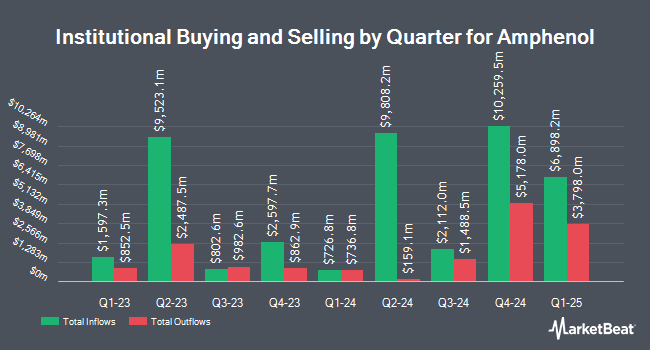

A number of other hedge funds and other institutional investors have also recently modified their holdings of the company. Vanguard Group Inc. lifted its stake in Amphenol by 1.4% in the fourth quarter. Vanguard Group Inc. now owns 152,127,847 shares of the electronics maker's stock worth $10,565,279,000 after purchasing an additional 2,108,578 shares during the last quarter. FMR LLC grew its position in Amphenol by 2.6% during the 4th quarter. FMR LLC now owns 104,250,575 shares of the electronics maker's stock worth $7,240,202,000 after acquiring an additional 2,643,752 shares during the last quarter. Price T Rowe Associates Inc. MD grew its holdings in shares of Amphenol by 36.8% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 58,911,813 shares of the electronics maker's stock worth $4,091,426,000 after purchasing an additional 15,837,407 shares during the last quarter. Geode Capital Management LLC raised its holdings in Amphenol by 2.7% during the 4th quarter. Geode Capital Management LLC now owns 25,325,653 shares of the electronics maker's stock valued at $1,754,672,000 after buying an additional 659,560 shares during the last quarter. Finally, Bank of America Corp DE boosted its position in Amphenol by 294.0% during the 4th quarter. Bank of America Corp DE now owns 24,953,591 shares of the electronics maker's stock valued at $1,733,027,000 after buying an additional 18,619,417 shares during the period. 97.01% of the stock is currently owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other Amphenol news, CEO Richard Adam Norwitt sold 2,000,000 shares of the company's stock in a transaction on Friday, April 25th. The stock was sold at an average price of $75.73, for a total value of $151,460,000.00. Following the transaction, the chief executive officer now owns 2,002,507 shares of the company's stock, valued at $151,649,855.11. This represents a 49.97% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, VP Lance E. D'amico sold 175,000 shares of Amphenol stock in a transaction on Friday, April 25th. The stock was sold at an average price of $76.28, for a total value of $13,349,000.00. Following the sale, the vice president now owns 51,400 shares of the company's stock, valued at approximately $3,920,792. This trade represents a 77.30% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 3,764,500 shares of company stock valued at $294,839,785 over the last three months. 1.67% of the stock is owned by company insiders.

Wall Street Analyst Weigh In

Several brokerages have commented on APH. Evercore ISI raised their price objective on shares of Amphenol from $88.00 to $105.00 and gave the stock an "outperform" rating in a report on Thursday, June 5th. Citigroup lifted their price target on Amphenol from $85.00 to $100.00 and gave the stock a "buy" rating in a research report on Tuesday, May 27th. JPMorgan Chase & Co. increased their target price on Amphenol from $85.00 to $91.00 and gave the company an "overweight" rating in a research note on Thursday, April 24th. Fox Advisors upgraded shares of Amphenol from an "equal weight" rating to an "overweight" rating and set a $85.00 price target for the company in a research note on Thursday, April 24th. Finally, The Goldman Sachs Group raised their target price on Amphenol from $90.00 to $102.00 and gave the stock a "buy" rating in a research report on Tuesday. Five research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the stock. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $88.00.

Get Our Latest Research Report on APH

Amphenol Price Performance

Shares of APH traded up $0.51 during midday trading on Wednesday, hitting $93.00. 6,436,441 shares of the company traded hands, compared to its average volume of 7,497,489. The stock has a market cap of $112.49 billion, a price-to-earnings ratio of 48.56, a PEG ratio of 1.92 and a beta of 1.12. The firm has a 50 day moving average of $78.33 and a 200-day moving average of $72.52. The company has a debt-to-equity ratio of 0.66, a quick ratio of 1.75 and a current ratio of 2.37. Amphenol Co. has a 52 week low of $54.77 and a 52 week high of $94.11.

Amphenol (NYSE:APH - Get Free Report) last released its quarterly earnings data on Wednesday, April 23rd. The electronics maker reported $0.63 EPS for the quarter, beating the consensus estimate of $0.52 by $0.11. The business had revenue of $4.81 billion during the quarter, compared to analyst estimates of $4.20 billion. Amphenol had a net margin of 15.92% and a return on equity of 25.67%. Amphenol's quarterly revenue was up 47.7% compared to the same quarter last year. During the same quarter last year, the business earned $0.40 earnings per share. On average, analysts forecast that Amphenol Co. will post 2.36 EPS for the current fiscal year.

Amphenol Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Wednesday, July 9th. Investors of record on Tuesday, June 17th will be issued a dividend of $0.165 per share. The ex-dividend date is Tuesday, June 17th. This represents a $0.66 annualized dividend and a yield of 0.71%. Amphenol's payout ratio is presently 32.04%.

Amphenol Profile

(

Free Report)

Amphenol Corporation, together with its subsidiaries, primarily designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally. It operates through three segments: Harsh Environment Solutions, Communications Solutions, and Interconnect and Sensor Systems.

Further Reading

Before you consider Amphenol, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amphenol wasn't on the list.

While Amphenol currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report