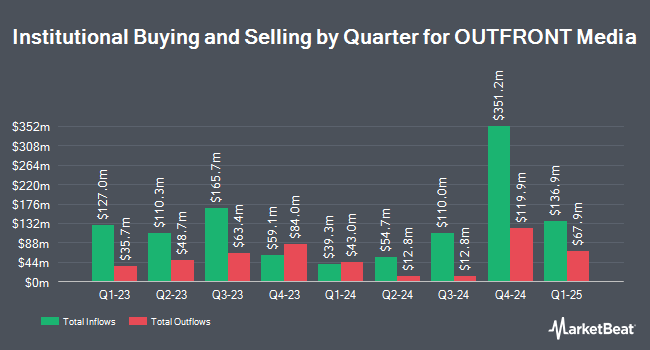

UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its stake in shares of OUTFRONT Media Inc. (NYSE:OUT - Free Report) by 13.6% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 430,880 shares of the financial services provider's stock after acquiring an additional 51,635 shares during the quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned about 0.27% of OUTFRONT Media worth $7,644,000 at the end of the most recent quarter.

Several other hedge funds and other institutional investors have also recently bought and sold shares of the stock. Loomis Sayles & Co. L P acquired a new position in OUTFRONT Media in the fourth quarter valued at $47,000. Sterling Capital Management LLC increased its stake in OUTFRONT Media by 672.5% in the fourth quarter. Sterling Capital Management LLC now owns 2,897 shares of the financial services provider's stock valued at $51,000 after purchasing an additional 2,522 shares during the period. Smartleaf Asset Management LLC increased its stake in OUTFRONT Media by 155.5% in the fourth quarter. Smartleaf Asset Management LLC now owns 4,198 shares of the financial services provider's stock valued at $73,000 after purchasing an additional 2,555 shares during the period. KBC Group NV increased its stake in OUTFRONT Media by 47.9% in the fourth quarter. KBC Group NV now owns 6,198 shares of the financial services provider's stock valued at $110,000 after purchasing an additional 2,006 shares during the period. Finally, Lazard Asset Management LLC acquired a new position in OUTFRONT Media in the fourth quarter valued at $113,000.

OUTFRONT Media Price Performance

Shares of NYSE OUT traded down $0.22 on Thursday, hitting $16.26. The company's stock had a trading volume of 2,135,679 shares, compared to its average volume of 1,659,604. OUTFRONT Media Inc. has a 12-month low of $12.95 and a 12-month high of $19.98. The company has a market capitalization of $2.72 billion, a price-to-earnings ratio of 11.59, a price-to-earnings-growth ratio of 1.06 and a beta of 1.84. The company has a debt-to-equity ratio of 4.00, a current ratio of 0.65 and a quick ratio of 0.65. The stock has a 50 day moving average of $15.39 and a 200-day moving average of $17.29.

OUTFRONT Media (NYSE:OUT - Get Free Report) last posted its quarterly earnings data on Thursday, May 8th. The financial services provider reported $0.14 earnings per share for the quarter, missing analysts' consensus estimates of $0.15 by ($0.01). The firm had revenue of $390.70 million during the quarter, compared to analyst estimates of $396.17 million. OUTFRONT Media had a net margin of 13.30% and a return on equity of 40.33%. As a group, research analysts predict that OUTFRONT Media Inc. will post 1.59 EPS for the current year.

OUTFRONT Media Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, May 30th. Investors of record on Friday, June 6th were given a dividend of $0.30 per share. This represents a $1.20 annualized dividend and a yield of 7.38%. The ex-dividend date of this dividend was Friday, June 6th. OUTFRONT Media's dividend payout ratio (DPR) is 78.95%.

Analyst Upgrades and Downgrades

A number of research analysts have recently issued reports on the stock. Citigroup reiterated a "buy" rating and set a $19.00 price target (up from $17.00) on shares of OUTFRONT Media in a research note on Thursday, May 29th. Wall Street Zen lowered shares of OUTFRONT Media from a "hold" rating to a "sell" rating in a research note on Monday, May 12th. Morgan Stanley dropped their price target on shares of OUTFRONT Media from $18.00 to $17.00 and set an "equal weight" rating on the stock in a research note on Thursday, May 1st. JPMorgan Chase & Co. dropped their price target on shares of OUTFRONT Media from $20.00 to $19.00 and set a "neutral" rating on the stock in a research note on Wednesday, May 21st. Finally, Wells Fargo & Company dropped their price target on shares of OUTFRONT Media from $22.00 to $17.00 and set an "overweight" rating on the stock in a research note on Friday, May 9th. One analyst has rated the stock with a sell rating, four have issued a hold rating and three have assigned a buy rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Hold" and an average price target of $18.23.

Read Our Latest Report on OUT

OUTFRONT Media Company Profile

(

Free Report)

OUTFRONT Media, Inc leases advertising space on out-of-home advertising structures and sites. Its inventory consists of billboard displays, which are primarily located on the most heavily traveled highways & roadways, and transit advertising displays operated under exclusive multi-year contracts with municipalities in large cities across the U.S.

Recommended Stories

Before you consider OUTFRONT Media, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OUTFRONT Media wasn't on the list.

While OUTFRONT Media currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.