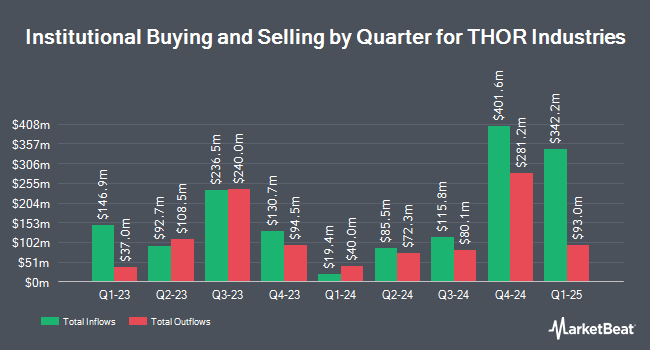

Jacobs Levy Equity Management Inc. grew its stake in THOR Industries, Inc. (NYSE:THO - Free Report) by 27.9% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 105,980 shares of the construction company's stock after acquiring an additional 23,103 shares during the period. Jacobs Levy Equity Management Inc. owned 0.20% of THOR Industries worth $10,143,000 at the end of the most recent reporting period.

Several other institutional investors have also recently made changes to their positions in THO. Janus Henderson Group PLC boosted its position in shares of THOR Industries by 1.0% in the 4th quarter. Janus Henderson Group PLC now owns 433,768 shares of the construction company's stock worth $41,518,000 after purchasing an additional 4,410 shares in the last quarter. Gotham Asset Management LLC grew its stake in shares of THOR Industries by 6.1% during the 4th quarter. Gotham Asset Management LLC now owns 87,955 shares of the construction company's stock worth $8,418,000 after purchasing an additional 5,034 shares during the period. Ethic Inc. purchased a new stake in shares of THOR Industries during the 4th quarter worth about $272,000. Fullcircle Wealth LLC grew its holdings in THOR Industries by 13.3% in the fourth quarter. Fullcircle Wealth LLC now owns 5,171 shares of the construction company's stock valued at $530,000 after purchasing an additional 607 shares during the period. Finally, Crestline Management LP acquired a new position in THOR Industries during the fourth quarter worth $883,000. Hedge funds and other institutional investors own 96.71% of the company's stock.

THOR Industries Stock Up 1.1%

Shares of NYSE:THO traded up $0.87 during trading on Friday, hitting $82.37. The company's stock had a trading volume of 618,842 shares, compared to its average volume of 637,894. The company has a market capitalization of $4.38 billion, a PE ratio of 21.07, a PEG ratio of 1.16 and a beta of 1.26. The stock's 50-day moving average price is $74.97 and its two-hundred day moving average price is $92.80. The company has a debt-to-equity ratio of 0.26, a quick ratio of 0.78 and a current ratio of 1.71. THOR Industries, Inc. has a fifty-two week low of $63.16 and a fifty-two week high of $118.85.

THOR Industries (NYSE:THO - Get Free Report) last released its quarterly earnings data on Wednesday, March 5th. The construction company reported ($0.01) earnings per share for the quarter, missing analysts' consensus estimates of $0.07 by ($0.08). THOR Industries had a return on equity of 5.97% and a net margin of 2.17%. The firm had revenue of $2.02 billion during the quarter, compared to analyst estimates of $1.98 billion. During the same period last year, the business earned $0.13 EPS. The firm's revenue was down 8.6% on a year-over-year basis. As a group, sell-side analysts expect that THOR Industries, Inc. will post 4.64 EPS for the current year.

THOR Industries Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Tuesday, April 22nd. Stockholders of record on Tuesday, April 8th were issued a $0.50 dividend. The ex-dividend date of this dividend was Tuesday, April 8th. This represents a $2.00 dividend on an annualized basis and a dividend yield of 2.43%. THOR Industries's dividend payout ratio is 53.05%.

Analysts Set New Price Targets

THO has been the subject of several research reports. Truist Financial dropped their price objective on shares of THOR Industries from $90.00 to $72.00 and set a "hold" rating for the company in a research note on Monday, April 14th. Bank of America raised shares of THOR Industries from a "neutral" rating to a "buy" rating and raised their price target for the company from $110.00 to $125.00 in a research report on Monday, March 3rd. KeyCorp cut their target price on shares of THOR Industries from $65.00 to $60.00 and set an "underweight" rating on the stock in a research note on Thursday, April 17th. Baird R W cut THOR Industries from a "strong-buy" rating to a "hold" rating in a research note on Friday, April 4th. Finally, BMO Capital Markets cut their target price on THOR Industries from $120.00 to $105.00 and set an "outperform" rating on the stock in a research report on Thursday, March 6th. One research analyst has rated the stock with a sell rating, seven have issued a hold rating and two have assigned a buy rating to the company's stock. According to MarketBeat, THOR Industries currently has a consensus rating of "Hold" and an average price target of $87.57.

Get Our Latest Stock Report on THO

THOR Industries Company Profile

(

Free Report)

THOR Industries, Inc designs, manufactures, and sells recreational vehicles (RVs), and related parts and accessories in the United States, Canada, and Europe. The company offers travel trailers; gasoline and diesel Class A, Class B, and Class C motorhomes; conventional travel trailers and fifth wheels; luxury fifth wheels; and motorcaravans, caravans, campervans, and urban vehicles.

Featured Articles

Before you consider THOR Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and THOR Industries wasn't on the list.

While THOR Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.