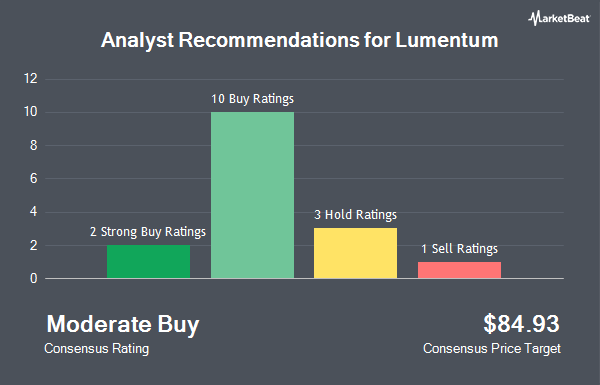

Lumentum Holdings Inc. (NASDAQ:LITE - Get Free Report) has been assigned an average recommendation of "Moderate Buy" from the sixteen ratings firms that are presently covering the firm, MarketBeat reports. One research analyst has rated the stock with a sell recommendation, three have assigned a hold recommendation, ten have given a buy recommendation and two have assigned a strong buy recommendation to the company. The average 12 month price objective among brokers that have updated their coverage on the stock in the last year is $82.20.

Several brokerages recently issued reports on LITE. BNP Paribas raised Lumentum from a "neutral" rating to an "outperform" rating and set a $92.00 price objective on the stock in a research note on Tuesday, March 11th. B. Riley upped their target price on Lumentum from $62.00 to $75.00 and gave the stock a "neutral" rating in a report on Friday, February 7th. JPMorgan Chase & Co. lowered their target price on Lumentum from $105.00 to $73.00 and set an "overweight" rating for the company in a report on Thursday, April 17th. Northland Capmk upgraded Lumentum from a "hold" rating to a "strong-buy" rating in a report on Monday, April 7th. Finally, Stifel Nicolaus upped their target price on Lumentum from $95.00 to $105.00 and gave the stock a "buy" rating in a report on Friday, February 7th.

Read Our Latest Report on Lumentum

Insider Buying and Selling at Lumentum

In other Lumentum news, SVP Jae Kim sold 4,577 shares of Lumentum stock in a transaction dated Friday, May 16th. The stock was sold at an average price of $77.98, for a total transaction of $356,914.46. Following the completion of the transaction, the senior vice president now owns 31,534 shares in the company, valued at approximately $2,459,021.32. This trade represents a 12.67% decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Also, insider Yuen Wupen sold 4,716 shares of Lumentum stock in a transaction dated Thursday, May 15th. The shares were sold at an average price of $76.87, for a total value of $362,518.92. Following the completion of the transaction, the insider now owns 82,957 shares of the company's stock, valued at approximately $6,376,904.59. This represents a 5.38% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 14,298 shares of company stock worth $1,081,764. Insiders own 0.19% of the company's stock.

Hedge Funds Weigh In On Lumentum

Several institutional investors and hedge funds have recently modified their holdings of LITE. UMB Bank n.a. boosted its holdings in Lumentum by 301.2% in the 4th quarter. UMB Bank n.a. now owns 337 shares of the technology company's stock worth $28,000 after buying an additional 253 shares during the last quarter. Jones Financial Companies Lllp boosted its holdings in Lumentum by 54.2% in the 4th quarter. Jones Financial Companies Lllp now owns 370 shares of the technology company's stock worth $31,000 after buying an additional 130 shares during the last quarter. CoreCap Advisors LLC boosted its holdings in Lumentum by 2,235.3% in the 4th quarter. CoreCap Advisors LLC now owns 397 shares of the technology company's stock worth $33,000 after buying an additional 380 shares during the last quarter. Skandinaviska Enskilda Banken AB publ acquired a new stake in Lumentum in the 1st quarter worth about $25,000. Finally, Rakuten Securities Inc. boosted its holdings in Lumentum by 164.4% in the 1st quarter. Rakuten Securities Inc. now owns 476 shares of the technology company's stock worth $30,000 after buying an additional 296 shares during the last quarter. Hedge funds and other institutional investors own 94.05% of the company's stock.

Lumentum Price Performance

Shares of Lumentum stock traded down $2.49 during trading hours on Friday, hitting $75.41. The company's stock had a trading volume of 1,750,100 shares, compared to its average volume of 1,994,493. The company has a debt-to-equity ratio of 2.94, a quick ratio of 3.60 and a current ratio of 4.76. The company has a market cap of $5.23 billion, a PE ratio of -9.81 and a beta of 1.18. Lumentum has a 12-month low of $38.29 and a 12-month high of $104.00. The business has a 50 day moving average price of $63.45 and a two-hundred day moving average price of $75.33.

Lumentum (NASDAQ:LITE - Get Free Report) last released its earnings results on Tuesday, May 6th. The technology company reported $0.57 EPS for the quarter, beating analysts' consensus estimates of $0.50 by $0.07. The firm had revenue of $425.20 million for the quarter, compared to analysts' expectations of $418.18 million. Lumentum had a negative return on equity of 7.25% and a negative net margin of 36.98%. The company's quarterly revenue was up 16.0% on a year-over-year basis. During the same quarter in the prior year, the firm posted $0.09 earnings per share. Analysts expect that Lumentum will post 0.03 earnings per share for the current fiscal year.

About Lumentum

(

Get Free ReportLumentum Holdings Inc manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa. The company operates through two segments: Optical Communications (OpComms) and Commercial Lasers (Lasers). The OpComms segment offers components, modules, and subsystems that enable the transmission and transport of video, audio, and data over high-capacity fiber optic cables.

Featured Stories

Before you consider Lumentum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lumentum wasn't on the list.

While Lumentum currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for June 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.