Nebula Research & Development LLC decreased its position in Oscar Health, Inc. (NYSE:OSCR - Free Report) by 71.1% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 35,014 shares of the company's stock after selling 85,981 shares during the period. Nebula Research & Development LLC's holdings in Oscar Health were worth $471,000 at the end of the most recent quarter.

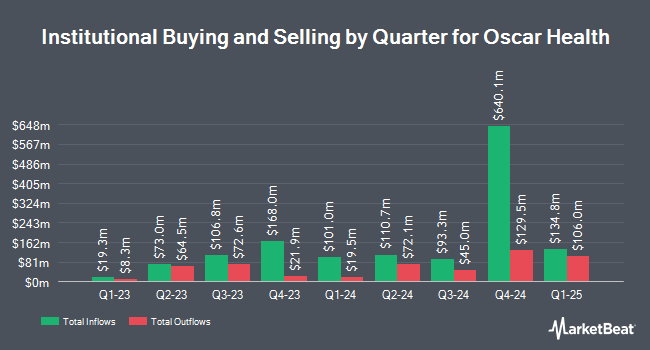

A number of other institutional investors have also bought and sold shares of the company. Vanguard Group Inc. boosted its stake in Oscar Health by 3.2% during the fourth quarter. Vanguard Group Inc. now owns 18,997,973 shares of the company's stock worth $255,333,000 after acquiring an additional 586,626 shares in the last quarter. JPMorgan Chase & Co. boosted its holdings in Oscar Health by 348.7% in the fourth quarter. JPMorgan Chase & Co. now owns 10,360,529 shares of the company's stock worth $139,246,000 after acquiring an additional 8,051,379 shares in the last quarter. BIT Capital GmbH grew its stake in Oscar Health by 5,711.6% in the fourth quarter. BIT Capital GmbH now owns 4,473,853 shares of the company's stock valued at $60,129,000 after acquiring an additional 4,396,872 shares during the period. Geode Capital Management LLC grew its position in Oscar Health by 3.0% in the 4th quarter. Geode Capital Management LLC now owns 4,468,098 shares of the company's stock valued at $60,065,000 after purchasing an additional 128,458 shares during the period. Finally, Hennessy Advisors Inc. increased its stake in Oscar Health by 550.3% during the 4th quarter. Hennessy Advisors Inc. now owns 4,188,400 shares of the company's stock valued at $56,292,000 after purchasing an additional 3,544,300 shares in the last quarter. Institutional investors own 75.70% of the company's stock.

Oscar Health Stock Down 1.9 %

Shares of NYSE OSCR traded down $0.25 during trading on Monday, hitting $12.95. The stock had a trading volume of 1,176,613 shares, compared to its average volume of 3,912,948. The firm has a fifty day moving average of $13.30 and a two-hundred day moving average of $14.64. The company has a market capitalization of $3.24 billion, a PE ratio of -649.13 and a beta of 1.75. The company has a debt-to-equity ratio of 0.26, a current ratio of 0.73 and a quick ratio of 0.73. Oscar Health, Inc. has a 12 month low of $11.20 and a 12 month high of $23.79.

Oscar Health (NYSE:OSCR - Get Free Report) last issued its quarterly earnings data on Tuesday, February 4th. The company reported ($0.62) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.55) by ($0.07). Oscar Health had a return on equity of 2.28% and a net margin of 0.28%. As a group, equities research analysts forecast that Oscar Health, Inc. will post 0.69 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

Separately, Wells Fargo & Company lowered shares of Oscar Health from an "overweight" rating to an "equal weight" rating and dropped their price objective for the company from $20.00 to $16.00 in a research note on Thursday, March 13th. Two equities research analysts have rated the stock with a sell rating, three have assigned a hold rating, two have issued a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, Oscar Health has a consensus rating of "Hold" and a consensus price target of $20.21.

Check Out Our Latest Stock Analysis on Oscar Health

About Oscar Health

(

Free Report)

Oscar Health, Inc operates as a health insurance in the United States. The company offers health plans in individual and small group markets, as well as +Oscar, a technology driven platform that help providers and payors directly enable their shift to value-based care. It also provides reinsurance products.

Featured Stories

Before you consider Oscar Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oscar Health wasn't on the list.

While Oscar Health currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.