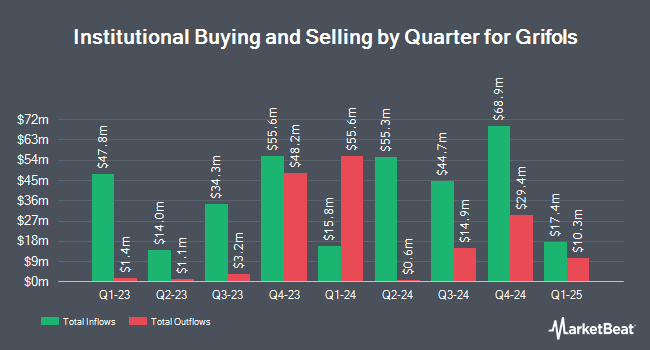

Oasis Management Co Ltd. grew its stake in Grifols, S.A. (NASDAQ:GRFS - Free Report) by 19.8% during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 1,157,607 shares of the biotechnology company's stock after purchasing an additional 191,137 shares during the quarter. Grifols makes up approximately 1.9% of Oasis Management Co Ltd.'s investment portfolio, making the stock its 11th largest holding. Oasis Management Co Ltd. owned approximately 0.17% of Grifols worth $8,613,000 as of its most recent SEC filing.

Several other large investors also recently modified their holdings of GRFS. GAMMA Investing LLC boosted its stake in Grifols by 44.5% in the 4th quarter. GAMMA Investing LLC now owns 4,959 shares of the biotechnology company's stock valued at $37,000 after purchasing an additional 1,527 shares during the period. Charles Schwab Investment Management Inc. lifted its position in shares of Grifols by 5.3% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 33,200 shares of the biotechnology company's stock valued at $247,000 after acquiring an additional 1,657 shares during the period. China Universal Asset Management Co. Ltd. lifted its position in shares of Grifols by 10.2% during the 4th quarter. China Universal Asset Management Co. Ltd. now owns 25,867 shares of the biotechnology company's stock valued at $192,000 after acquiring an additional 2,403 shares during the period. R Squared Ltd bought a new stake in shares of Grifols during the 4th quarter valued at $28,000. Finally, HighTower Advisors LLC lifted its position in shares of Grifols by 28.3% during the 4th quarter. HighTower Advisors LLC now owns 17,866 shares of the biotechnology company's stock valued at $133,000 after acquiring an additional 3,936 shares during the period.

Grifols Price Performance

Shares of NASDAQ:GRFS traded down $0.09 during trading on Friday, reaching $7.76. 908,618 shares of the company traded hands, compared to its average volume of 1,171,853. The company has a quick ratio of 0.79, a current ratio of 2.26 and a debt-to-equity ratio of 1.11. Grifols, S.A. has a 52 week low of $5.79 and a 52 week high of $9.96. The firm has a market capitalization of $5.34 billion, a PE ratio of 6.63 and a beta of 0.44. The company's 50 day moving average is $7.29 and its two-hundred day moving average is $7.63.

Analyst Upgrades and Downgrades

A number of analysts have recently weighed in on GRFS shares. StockNews.com upgraded Grifols from a "hold" rating to a "buy" rating in a research report on Thursday. Morgan Stanley started coverage on Grifols in a research report on Wednesday, February 12th. They set an "overweight" rating for the company.

Read Our Latest Stock Report on GRFS

Grifols Profile

(

Free Report)

Grifols, SA operates as a plasma therapeutic company in Spain, the United States, Canada, and internationally. The company provides immunoglobulin to treat immunodeficiencies; albumin used to restore circulatory volume and protein loss in pathophysiological conditions, such as liver cirrhosis, cardiocirculatory failure, trauma and severe burns; alpha-1 proteinase inhibitor, a plasma protein, used to treat a genetic disease known as alpha-1; factorVIII/von Willerbrand factor and factor IX, clotting factors for the treatment of hemophilia A and von Willebrand's disease, as well as hemophilia B; antithrombin III to treat hereditary antithrombin deficiency; Fostamatinib, a spleen tyrosine kinase inhibitor; combination of fibrinogen and enzyme thrombin that acts as a biological sealant to control surgical bleeding; and plasma exchange with albumin used to treat Alzheimer's disease.

See Also

Before you consider Grifols, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grifols wasn't on the list.

While Grifols currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.