Royalty Pharma (NASDAQ:RPRX - Get Free Report) was upgraded by equities researchers at StockNews.com from a "hold" rating to a "buy" rating in a research report issued to clients and investors on Monday.

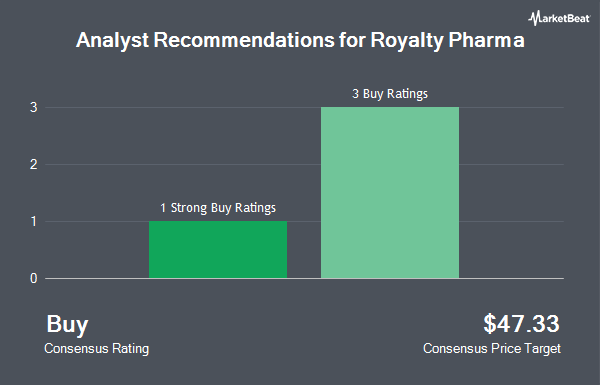

Separately, Citigroup reissued a "buy" rating on shares of Royalty Pharma in a research note on Friday, March 28th. One analyst has rated the stock with a hold rating, four have given a buy rating and one has issued a strong buy rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Buy" and an average target price of $42.50.

Check Out Our Latest Stock Analysis on Royalty Pharma

Royalty Pharma Trading Up 2.7%

Shares of RPRX traded up $0.90 during trading hours on Monday, hitting $34.02. 4,933,445 shares of the stock traded hands, compared to its average volume of 3,341,547. The company has a current ratio of 1.44, a quick ratio of 1.44 and a debt-to-equity ratio of 0.64. Royalty Pharma has a 1-year low of $24.05 and a 1-year high of $34.20. The firm has a market capitalization of $19.61 billion, a PE ratio of 23.46, a price-to-earnings-growth ratio of 2.31 and a beta of 0.49. The business has a fifty day moving average of $32.39 and a 200-day moving average of $29.97.

Royalty Pharma (NASDAQ:RPRX - Get Free Report) last issued its quarterly earnings results on Thursday, May 8th. The biopharmaceutical company reported $1.06 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.99 by $0.07. Royalty Pharma had a return on equity of 24.40% and a net margin of 37.94%. The business had revenue of $839.00 million for the quarter, compared to analyst estimates of $724.69 million. Analysts expect that Royalty Pharma will post 4.49 EPS for the current year.

Hedge Funds Weigh In On Royalty Pharma

Several hedge funds have recently added to or reduced their stakes in the stock. Adage Capital Partners GP L.L.C. increased its holdings in shares of Royalty Pharma by 42.6% in the fourth quarter. Adage Capital Partners GP L.L.C. now owns 16,968,321 shares of the biopharmaceutical company's stock worth $432,862,000 after acquiring an additional 5,069,127 shares in the last quarter. Swedbank AB increased its holdings in shares of Royalty Pharma by 10.3% in the fourth quarter. Swedbank AB now owns 12,164,170 shares of the biopharmaceutical company's stock worth $310,308,000 after acquiring an additional 1,136,800 shares in the last quarter. Geode Capital Management LLC increased its holdings in shares of Royalty Pharma by 0.6% in the fourth quarter. Geode Capital Management LLC now owns 7,312,551 shares of the biopharmaceutical company's stock worth $186,846,000 after acquiring an additional 46,765 shares in the last quarter. Norges Bank bought a new stake in shares of Royalty Pharma in the fourth quarter worth about $124,498,000. Finally, Two Sigma Advisers LP increased its holdings in shares of Royalty Pharma by 21.1% in the fourth quarter. Two Sigma Advisers LP now owns 3,673,200 shares of the biopharmaceutical company's stock worth $93,703,000 after acquiring an additional 640,000 shares in the last quarter. Institutional investors and hedge funds own 54.35% of the company's stock.

About Royalty Pharma

(

Get Free Report)

Royalty Pharma plc operates as a buyer of biopharmaceutical royalties and a funder of innovations in the biopharmaceutical industry in the United States. It is also involved in the identification, evaluation, and acquisition of royalties on various biopharmaceutical therapies. In addition, the company collaborates with innovators from academic institutions, research hospitals and not-for-profits, small and mid-cap biotechnology companies, and pharmaceutical companies.

Featured Articles

Before you consider Royalty Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royalty Pharma wasn't on the list.

While Royalty Pharma currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.