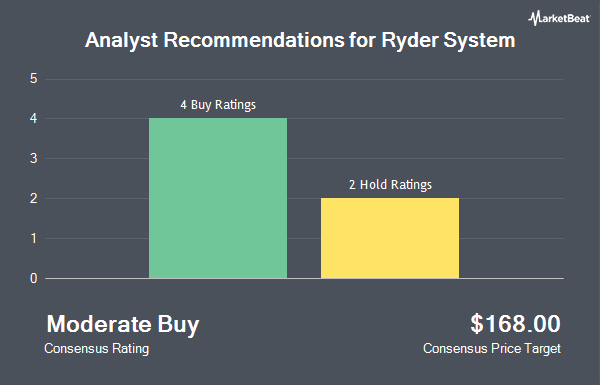

Shares of Ryder System, Inc. (NYSE:R - Get Free Report) have been given an average recommendation of "Moderate Buy" by the six analysts that are covering the stock, Marketbeat reports. Two analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. The average 1 year target price among brokerages that have covered the stock in the last year is $160.50.

Several equities analysts have recently issued reports on R shares. StockNews.com lowered Ryder System from a "buy" rating to a "hold" rating in a research report on Wednesday, March 26th. JPMorgan Chase & Co. lowered their price objective on shares of Ryder System from $174.00 to $165.00 and set a "neutral" rating on the stock in a research report on Thursday, April 24th. Finally, Stephens dropped their target price on Ryder System from $168.00 to $150.00 and set an "equal weight" rating on the stock in a research report on Friday, April 25th.

Get Our Latest Stock Analysis on Ryder System

Insider Buying and Selling at Ryder System

In other news, Director E Follin Smith sold 1,243 shares of the stock in a transaction that occurred on Monday, May 5th. The stock was sold at an average price of $144.38, for a total transaction of $179,464.34. Following the completion of the transaction, the director now directly owns 39,802 shares in the company, valued at approximately $5,746,612.76. This represents a 3.03% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 5.20% of the company's stock.

Hedge Funds Weigh In On Ryder System

Institutional investors have recently bought and sold shares of the business. Wealthfront Advisers LLC purchased a new position in Ryder System during the fourth quarter worth $314,075,000. Earnest Partners LLC lifted its stake in Ryder System by 2.4% in the fourth quarter. Earnest Partners LLC now owns 1,905,223 shares of the transportation company's stock worth $298,853,000 after purchasing an additional 45,393 shares during the last quarter. LSV Asset Management grew its stake in shares of Ryder System by 0.3% during the first quarter. LSV Asset Management now owns 1,456,453 shares of the transportation company's stock valued at $209,453,000 after buying an additional 4,912 shares during the last quarter. Sei Investments Co. lifted its stake in shares of Ryder System by 1.6% during the 4th quarter. Sei Investments Co. now owns 856,507 shares of the transportation company's stock worth $134,351,000 after acquiring an additional 13,529 shares during the last quarter. Finally, American Century Companies Inc. boosted its holdings in Ryder System by 0.3% during the 4th quarter. American Century Companies Inc. now owns 843,895 shares of the transportation company's stock valued at $132,373,000 after acquiring an additional 2,121 shares during the period. Institutional investors own 87.47% of the company's stock.

Ryder System Trading Up 1.5%

Shares of NYSE R traded up $2.36 during midday trading on Thursday, hitting $158.92. 43,978 shares of the company traded hands, compared to its average volume of 313,401. Ryder System has a 12-month low of $116.58 and a 12-month high of $171.78. The firm has a market cap of $6.57 billion, a P/E ratio of 14.33 and a beta of 0.94. The stock has a 50-day moving average price of $141.38 and a 200 day moving average price of $153.96. The company has a debt-to-equity ratio of 2.14, a quick ratio of 0.75 and a current ratio of 0.75.

Ryder System (NYSE:R - Get Free Report) last issued its quarterly earnings results on Wednesday, April 23rd. The transportation company reported $2.46 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.40 by $0.06. Ryder System had a net margin of 3.87% and a return on equity of 17.23%. The company had revenue of $3.13 billion during the quarter, compared to analysts' expectations of $3.17 billion. During the same period last year, the company posted $2.14 EPS. Ryder System's revenue was up 1.1% on a year-over-year basis. As a group, analysts expect that Ryder System will post 13.68 earnings per share for the current year.

Ryder System Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, June 20th. Investors of record on Monday, May 19th will be paid a dividend of $0.81 per share. This represents a $3.24 annualized dividend and a yield of 2.04%. The ex-dividend date of this dividend is Monday, May 19th. Ryder System's dividend payout ratio (DPR) is presently 28.25%.

About Ryder System

(

Get Free ReportRyder System, Inc operates as a logistics and transportation company worldwide. It operates through three segments: Fleet Management Solutions (FMS), Supply Chain Solutions (SCS), and Dedicated Transportation Solutions (DTS). The FMS segment offers full-service leasing and leasing with flexible maintenance options; commercial vehicle rental services; and contract or transactional maintenance services of trucks, tractors, and trailers; access to diesel fuel; and fuel planning and tax reporting, cards, and monitoring services, and centralized billing, as well as sells used vehicles through its retail sales centers and www.ryder.com/used-trucks website, as well as digital and technology support services.

Read More

Before you consider Ryder System, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ryder System wasn't on the list.

While Ryder System currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.