Schonfeld Strategic Advisors LLC bought a new position in shares of Travelzoo (NASDAQ:TZOO - Free Report) in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm bought 22,973 shares of the information services provider's stock, valued at approximately $458,000. Schonfeld Strategic Advisors LLC owned approximately 0.19% of Travelzoo at the end of the most recent quarter.

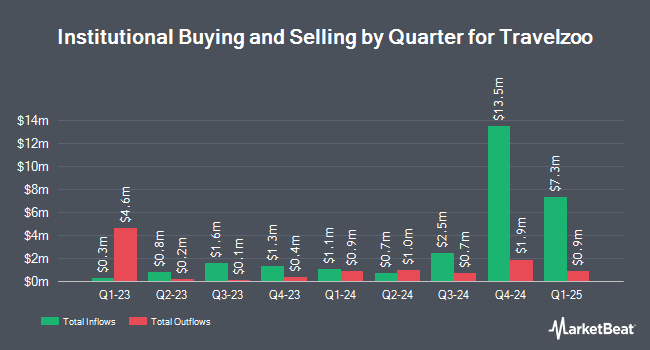

Several other institutional investors have also recently made changes to their positions in the business. JPMorgan Chase & Co. boosted its stake in Travelzoo by 352.5% during the fourth quarter. JPMorgan Chase & Co. now owns 57,224 shares of the information services provider's stock valued at $1,142,000 after buying an additional 44,578 shares during the last quarter. Arrowstreet Capital Limited Partnership bought a new position in Travelzoo during the fourth quarter valued at approximately $2,102,000. Jane Street Group LLC bought a new stake in shares of Travelzoo in the 3rd quarter valued at approximately $298,000. Geode Capital Management LLC lifted its stake in shares of Travelzoo by 10.6% in the 3rd quarter. Geode Capital Management LLC now owns 82,241 shares of the information services provider's stock valued at $991,000 after purchasing an additional 7,857 shares during the last quarter. Finally, Renaissance Technologies LLC lifted its stake in shares of Travelzoo by 17.9% in the 4th quarter. Renaissance Technologies LLC now owns 710,182 shares of the information services provider's stock valued at $14,168,000 after purchasing an additional 107,681 shares during the last quarter. Hedge funds and other institutional investors own 27.39% of the company's stock.

Insiders Place Their Bets

In other news, major shareholder Azzurro Capital Inc sold 2,500 shares of the firm's stock in a transaction that occurred on Thursday, May 1st. The stock was sold at an average price of $14.43, for a total value of $36,075.00. Following the transaction, the insider now owns 4,295,196 shares in the company, valued at $61,979,678.28. This trade represents a 0.06% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Also, CEO Holger Bartel sold 4,000 shares of Travelzoo stock in a transaction that occurred on Wednesday, March 5th. The stock was sold at an average price of $15.42, for a total value of $61,680.00. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 104,000 shares of company stock worth $1,507,630. 57.45% of the stock is owned by corporate insiders.

Analyst Ratings Changes

Several equities research analysts have recently issued reports on the company. Noble Financial reaffirmed an "outperform" rating on shares of Travelzoo in a research note on Wednesday, April 30th. Barrington Research reiterated an "outperform" rating and issued a $17.00 price target on shares of Travelzoo in a report on Tuesday, April 29th. Five research analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, Travelzoo currently has an average rating of "Buy" and a consensus price target of $25.00.

View Our Latest Research Report on Travelzoo

Travelzoo Price Performance

Travelzoo stock traded up $0.07 during midday trading on Friday, reaching $13.79. The company's stock had a trading volume of 19,032 shares, compared to its average volume of 127,076. The stock's 50-day simple moving average is $13.37 and its 200-day simple moving average is $17.24. The stock has a market capitalization of $155.01 million, a P/E ratio of 12.90 and a beta of 1.21. Travelzoo has a 52-week low of $7.12 and a 52-week high of $24.85.

Travelzoo (NASDAQ:TZOO - Get Free Report) last announced its quarterly earnings data on Wednesday, April 30th. The information services provider reported $0.25 earnings per share for the quarter, missing analysts' consensus estimates of $0.27 by ($0.02). The firm had revenue of $23.14 million during the quarter, compared to analyst estimates of $22.99 million. Travelzoo had a net margin of 16.67% and a return on equity of 210.54%. As a group, equities research analysts expect that Travelzoo will post 1.09 earnings per share for the current fiscal year.

About Travelzoo

(

Free Report)

Travelzoo, together with its subsidiaries, operates as an Internet media company that provides travel, entertainment, and local experiences worldwide. It operates in four segments: Travelzoo North America, Travelzoo Europe, Jack's Flight Club, and New Initiatives. The company offers Travelzoo website, Travelzoo Top 20 email newsletters, Standalone email newsletters, Travelzoo Network, Travelzoo mobile applications, Jack's Flight Club website, Jack's Flight Club mobile applications, and Jack's Flight Club newsletters.

Further Reading

Before you consider Travelzoo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Travelzoo wasn't on the list.

While Travelzoo currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.