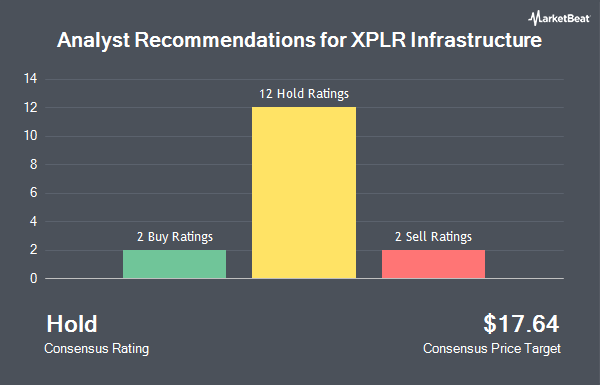

XPLR Infrastructure, LP (NYSE:XIFR - Get Free Report) has been assigned a consensus rating of "Hold" from the sixteen brokerages that are presently covering the company, MarketBeat reports. Two analysts have rated the stock with a sell recommendation, twelve have issued a hold recommendation and two have issued a buy recommendation on the company. The average 12 month target price among brokerages that have covered the stock in the last year is $17.64.

Several analysts recently issued reports on XIFR shares. Mizuho decreased their target price on XPLR Infrastructure from $15.00 to $12.00 and set a "neutral" rating on the stock in a research note on Monday, May 12th. Wells Fargo & Company decreased their target price on XPLR Infrastructure from $33.00 to $13.00 and set an "equal weight" rating on the stock in a research note on Wednesday, January 29th. Guggenheim decreased their target price on XPLR Infrastructure from $17.00 to $12.00 and set a "neutral" rating on the stock in a research note on Wednesday, January 29th. Scotiabank decreased their target price on XPLR Infrastructure from $15.00 to $12.00 and set a "sector perform" rating on the stock in a research note on Wednesday, January 29th. Finally, Morgan Stanley reissued an "underweight" rating and set a $13.00 target price (down previously from $22.00) on shares of XPLR Infrastructure in a research note on Monday, February 3rd.

Check Out Our Latest Stock Report on XPLR Infrastructure

XPLR Infrastructure Stock Up 1.9%

NYSE XIFR opened at $9.77 on Friday. The stock's 50-day moving average price is $8.85 and its 200-day moving average price is $12.74. The company has a quick ratio of 1.78, a current ratio of 2.02 and a debt-to-equity ratio of 0.37. XPLR Infrastructure has a 52 week low of $7.53 and a 52 week high of $35.15. The company has a market capitalization of $918.01 million, a P/E ratio of -97.70 and a beta of 0.93.

XPLR Infrastructure (NYSE:XIFR - Get Free Report) last posted its quarterly earnings data on Thursday, May 8th. The solar energy provider reported ($1.05) EPS for the quarter, missing the consensus estimate of $0.25 by ($1.30). XPLR Infrastructure had a positive return on equity of 1.34% and a negative net margin of 0.73%. During the same period in the prior year, the company posted $0.75 earnings per share. The firm's revenue for the quarter was up 9.7% compared to the same quarter last year. On average, equities research analysts predict that XPLR Infrastructure will post 2.33 earnings per share for the current year.

Hedge Funds Weigh In On XPLR Infrastructure

Institutional investors have recently added to or reduced their stakes in the company. Concurrent Investment Advisors LLC boosted its holdings in shares of XPLR Infrastructure by 18.8% in the 4th quarter. Concurrent Investment Advisors LLC now owns 21,410 shares of the solar energy provider's stock worth $381,000 after purchasing an additional 3,387 shares during the period. Good Life Advisors LLC purchased a new position in shares of XPLR Infrastructure in the 4th quarter worth approximately $218,000. Alberta Investment Management Corp purchased a new position in shares of XPLR Infrastructure in the 4th quarter worth approximately $1,737,000. Truist Financial Corp boosted its holdings in shares of XPLR Infrastructure by 10.1% in the 4th quarter. Truist Financial Corp now owns 11,434 shares of the solar energy provider's stock worth $204,000 after purchasing an additional 1,049 shares during the period. Finally, Castellan Group boosted its holdings in shares of XPLR Infrastructure by 4.6% in the 4th quarter. Castellan Group now owns 131,599 shares of the solar energy provider's stock worth $2,342,000 after purchasing an additional 5,772 shares during the period. Hedge funds and other institutional investors own 66.01% of the company's stock.

About XPLR Infrastructure

(

Get Free ReportXPLR Infrastructure LP engages in the acquisition, management, and ownership of contracted clean energy projects with long-term cash flows. It owns interests in wind and solar projects in North America and natural gas infrastructure assets in Texas. The company was founded on March 6, 2014 and is headquartered in Juno Beach, FL.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to [email protected].

Before you consider XPLR Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and XPLR Infrastructure wasn't on the list.

While XPLR Infrastructure currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.